HSA/HDHP Limits Increase for 2023

On April 29, 2022, the IRS released Revenue Procedure 2022-24 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2023. The IRS is required to publish these limits by June 1 of each year.

HIGHLIGHTS

- Each year, the IRS announces inflation-adjusted limits for HSAs and HDHPs.

- By law, the IRS is required to announce these limits by June 1 of each year.

- The adjusted contribution limits for HSAs take effect as of Jan. 1, 2023.

- The adjusted HDHP cost-sharing limits take effect for the plan year beginning on or after Jan. 1, 2023.

These limits vary based on whether an individual has self-only or family coverage under an HDHP.

Eligible individuals with self-only HDHP coverage will be able to contribute $3,850 to their HSAs for 2023, up from $3,650 for 2022. Eligible individuals with family HDHP coverage will be able to contribute $7,750 to their HSAs for 2023, up from $7,300 for 2022. Individuals age 55 or older may make an additional $1,000 “catch-up” contribution to their HSAs.

The minimum deductible amount for HDHPs increases to $1,500 for self-only coverage and $3,000 for family coverage for 2023 (up from $1,400 for self-only coverage and $2,800 for family coverage for 2022). The HDHP maximum out-of-pocket expense limit increases to $7,500 for self-only coverage and $15,000 for family coverage for 2023 (up from $7,050 for self-only coverage and $14,100 for family coverage for 2022).

HSA/HDHP Limits

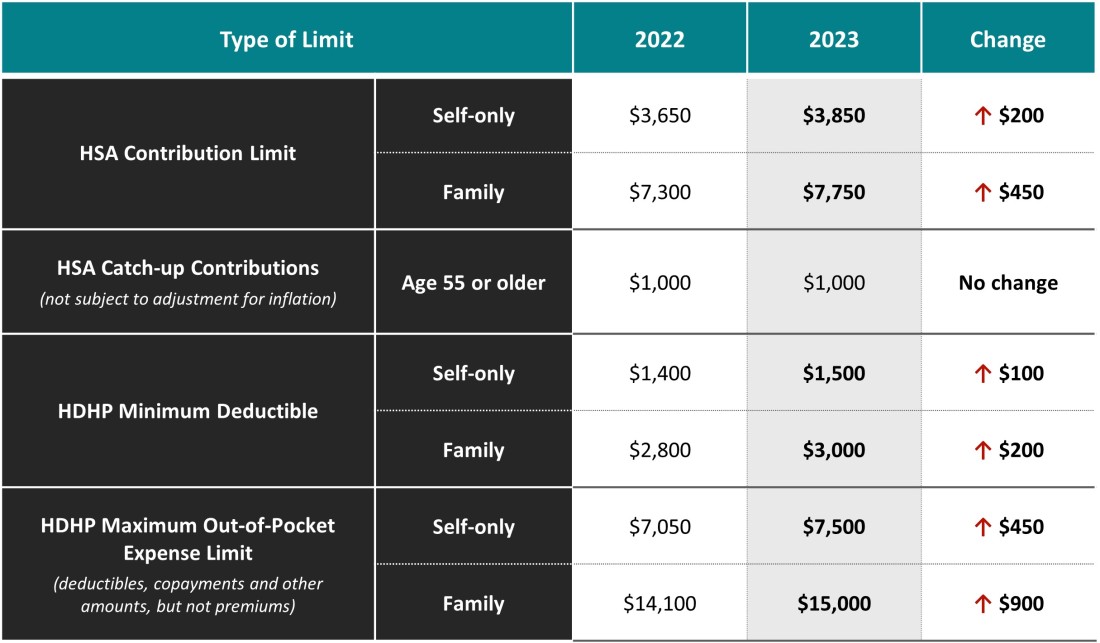

The following chart shows the HSA and HDHP limits for 2023 as compared to 2022. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

IMPORTANT DATES

January 1, 2023

The new contribution limits for HSAs become effective.

2023 Plan Years

The HDHP cost-sharing limits for 2023 apply for plan years beginning on or after Jan. 1, 2023.

ACTION STEPS

Employers that sponsor HDHPs should review their plan’s cost-sharing limits (minimum deductibles and maximum out-of-pocket expense limit) when preparing for the plan year beginning in 2023. Also, employers that allow employees to make pre-tax HSA contributions should update their plan communications for the increased contribution limits.

Prev

Prev