Medicare’s Coordination of Benefits Rules

Employers sponsoring group health plans that cover individuals enrolled in Medicare should understand Medicare’s “Coordination of Benefits (COB)" rules, which determine whether the group health plan or Medicare pays first on health care claims.

The “primary payer” pays what it owes on a health care claim first. If the primary payer does not pay the health care claim in full, the claim is sent to the “secondary payer” to pay any remaining covered portion.

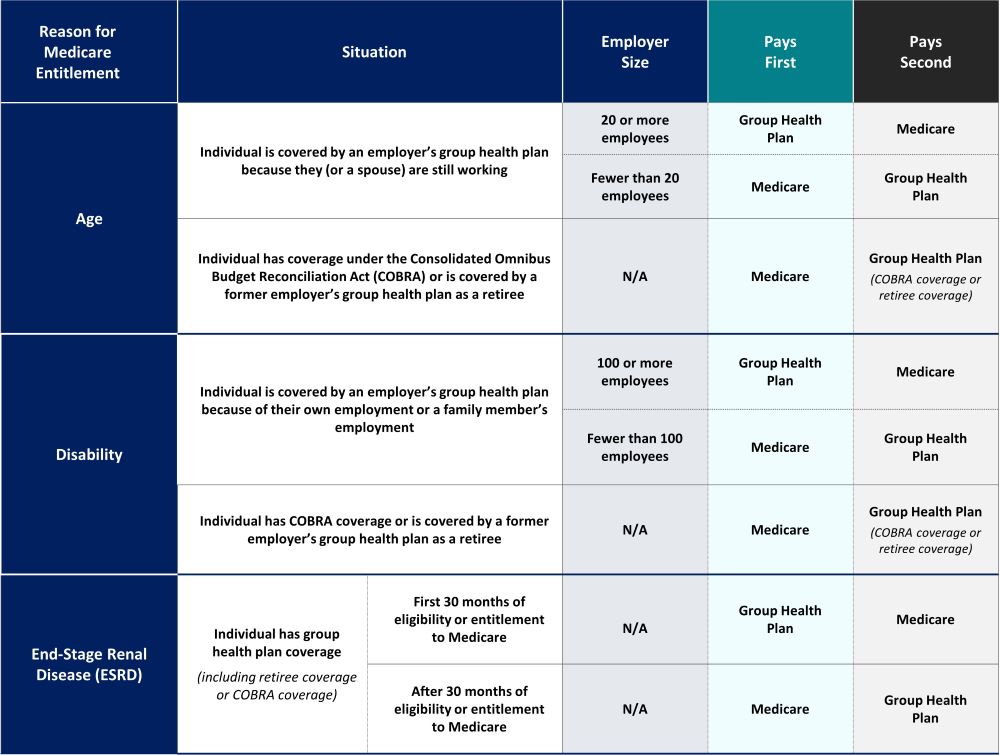

When an individual has both Medicare and employer- sponsored health plan coverage, the payer status of each type of coverage depends on a number of factors, including the reason for Medicare entitlement and, in some cases, the size of the employer.

The following chart summarizes Medicare’s COB rules for employer-sponsored health plans.

Employer Compliance Reminder:

Knowing Medicare’s payer status is important, as employers that sponsor group health plans that are primary to Medicare must comply with the Medicare Secondary Payer rules.

Prev

Prev