ACA Reporting Deadlines and Penalties Cheat Sheet

Employers subject to Affordable Care Act (ACA) reporting under Internal Revenue Code Sections 6055 or 6056 should prepare to comply with reporting deadlines in early 2024. The following employers are subject to ACA reporting under Sections 6055 and 6056:

- Employers with self-insured health plans (Section 6055 reporting); and

- Applicable large employers (ALEs) with either fully insured or self-insured health plans (Section 6056 reporting). ALEs are employers with 50 or more full-time employees (including full-time equivalent employees) during the preceding calendar year.

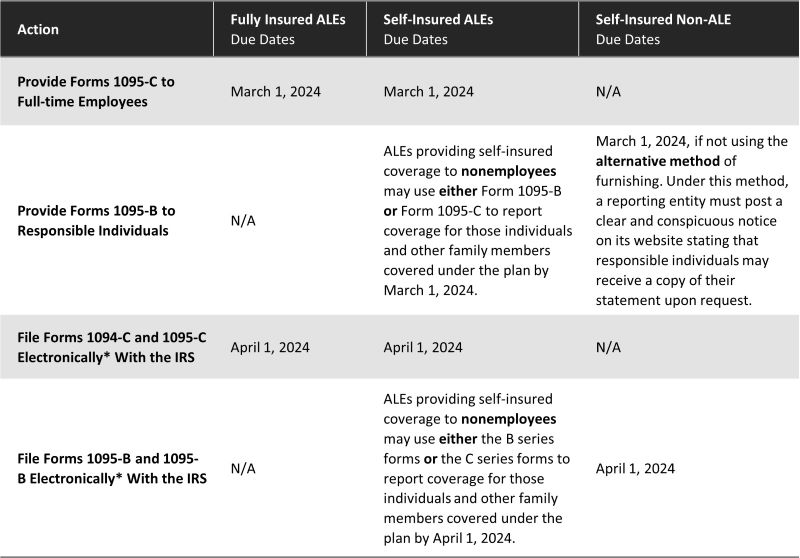

REPORTING DEADLINES

The following chart provides the ACA reporting due dates for 2023 calendar year reporting. Note that there are no reporting obligations for non-ALEs without a plan or non-ALEs with fully insured plans (because non-ALEs are not subject to Section 6056 reporting and the carrier will complete Section 6055 reporting).

*Beginning in 2024, reporting entities that file at least 10 returns during the calendar year must file electronically. Reporting entities must aggregate most information returns, such as Forms W-2 and 1099, to determine if they meet the 10-return threshold for mandatory electronic filing.

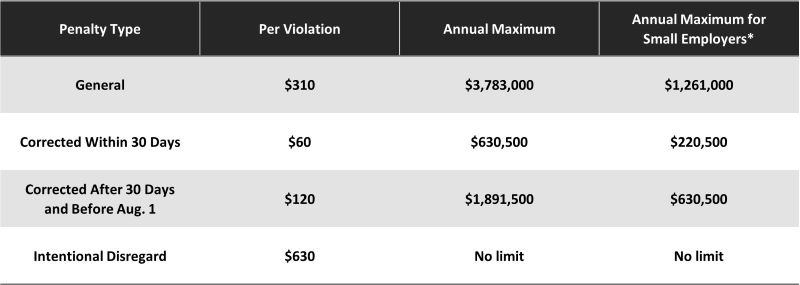

ADJUSTED REPORTING PENALTIES

The following chart provides the different types of penalties that can apply for 2023 returns and individual statements that are filed and furnished in 2024. A reporting entity that fails to comply with the ACA reporting requirements may be subject to the general reporting penalties for:

- Failure to file correct information returns (under Code Section 6721); and

- Failure to furnish correct payee statements (under Code Section 6722).

However, penalties may be waived if the failure is due to reasonable cause and not willful neglect. Penalties may also be reduced if the reporting entity corrects the failure within a certain period of time, as shown below.

*The maximum penalty amounts are different for small businesses and large businesses. For purposes of the penalty maximum, a small employer is one that has average annual gross receipts of up to $5 million for the three most recent taxable years. There is no maximum penalty for intentional disregard.

Prev

Prev