2026 Benefit and Retirement Plan Limits and Thresholds

Many employee benefits are subject to annual dollar limits that are adjusted for inflation by the IRS each year. The following commonly offered employee benefits are subject to these limits:

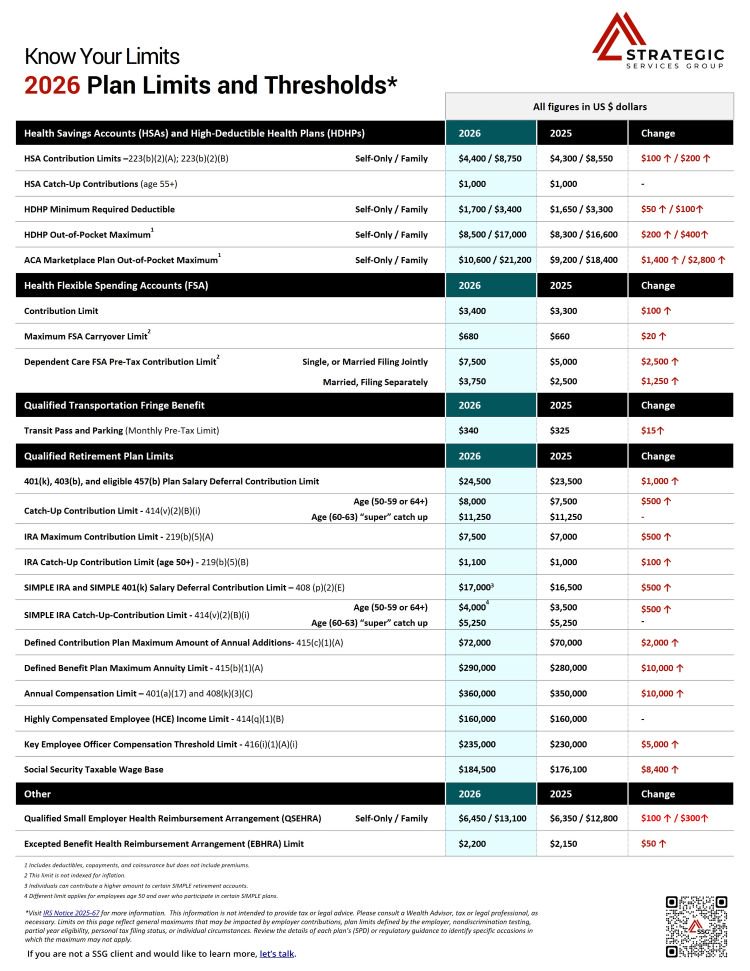

This SSG Compliance Advisor includes a 2025-2026 comparison chart of inflation-adjusted limits, most of which will increase for 2026.

2026 Increased Limits

- HDHPs and Health Savings Accounts (HSAs);

- Health Flexible Spending Accounts (FSAs);

- 401(k) plans;

- Monthly limits for transportation fringe benefit plans; and

- Qualified Retirement plan limits.

Contact us if you would like to speak to a Benefits Advisor about reevaluating your company benefits.

Prev

Prev